Understanding Director’s Loans in UK Limited Companies

What You Need to Know as a Director of a company

If you’re a company director, it’s not uncommon to take a loan from your own limited company. While this is perfectly legal, HMRC has strict rules on how these loans must be handled. Failure to follow the rules can result in unexpected tax charges — both for you and your company.

In this blog post, we’ll explain the key rules and highlight two common scenarios that every director should understand.

💼 What Is a Director’s Loan?

A director’s loan is money taken from your company that isn’t:

Salary

Dividend

Expense reimbursement

Repayment of money you’ve previously loaned to the company

It’s recorded in a Director’s Loan Account (DLA) and must be managed carefully to avoid tax complications.

🔍 Scenario 1: The Loan Exceeds £10,000

If your loan balance goes over £10,000 at any point in the company’s accounting year, several tax implications kick in:

(A) Repayment Deadline

You must repay the loan within 9 months and 1 day after the company’s year-end. If not, the company must pay a temporary tax to HMRC. This is called Section 455 Tax.

🧾 Section 455 Tax

Tax rate: 33.75% of the outstanding loan

Payable by the company if the loan isn’t repaid in time

Can be reclaimed once the loan is fully repaid

(B) Benefit in Kind

If the loan is interest-free (or charged below HMRC’s official rate):

It’s treated as a taxable benefit

You, the director, may owe personal tax

The company must pay Class 1A National Insurance

(C) Reporting Requirements

The benefit must be declared on a P11D form

The director may need to report the benefit on their Self Assessment tax return

💼 Scenario 2: The Loan Remains at or Below £10,000

If your director’s loan never exceeds £10,000 throughout the year:

(A) Same Repayment Deadline

The 9-month rule still applies. You must repay the loan within that period to avoid Section 455 tax.

(B) No Benefit in Kind

As long as the loan stays under £10,000:

No taxable benefit arises

No income tax or NIC applies

No P11D is required

(C) Still Needs to Be Accounted For

Even if there are no tax charges, the loan must still be recorded in the company’s accounts.

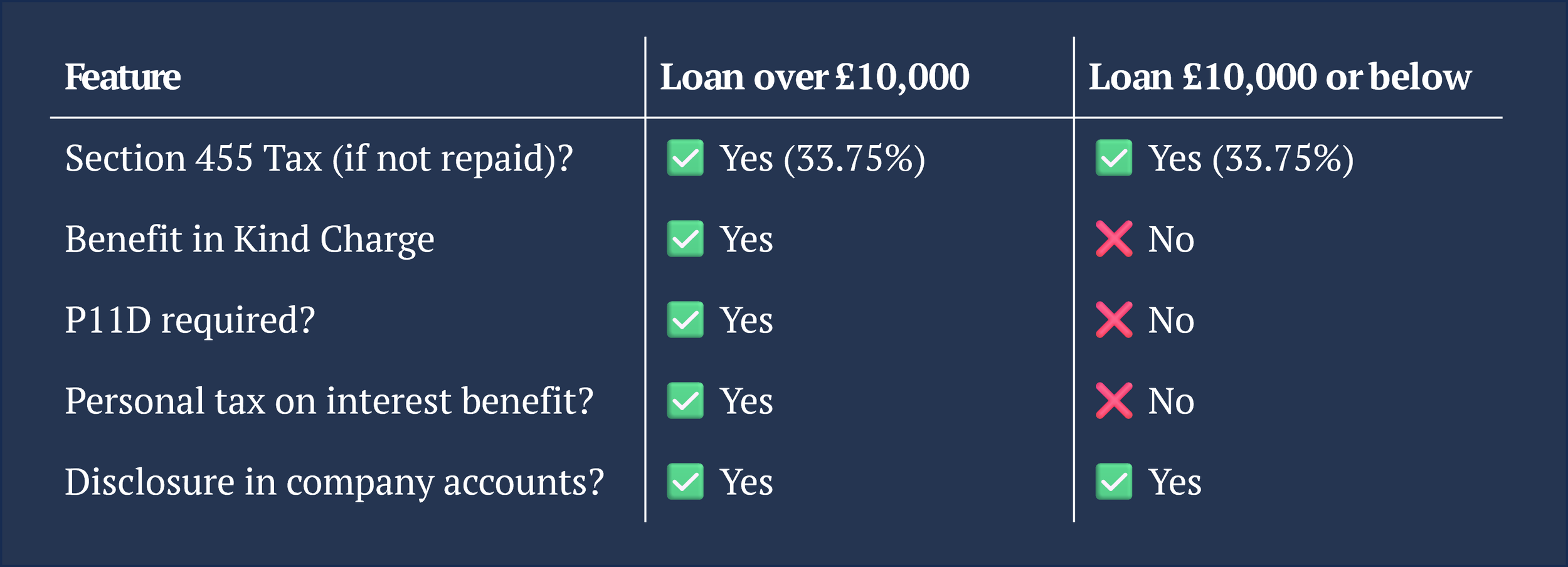

📊 Summary at a Glance

⚠️ Additional Considerations

A director’s loan is not a substitute for salary or dividends, both of which have their own tax implications.

If the company writes off the loan, HMRC will treat it as taxable income for the director.

Accurate bookkeeping and documentation are critical — HMRC regularly reviews director loan arrangements.

📬 Need Help Managing Your Director’s Loan?

At Satya Accountants, we help directors stay compliant with HMRC rules while planning their remuneration efficiently. If you’ve taken a loan or are considering one, speak to us early so we can guide you on tax-efficient options and avoid unnecessary penalties.

Email: info@satya.accountants